Why Navigate?

A Unique Thesis & Market Phenomenon

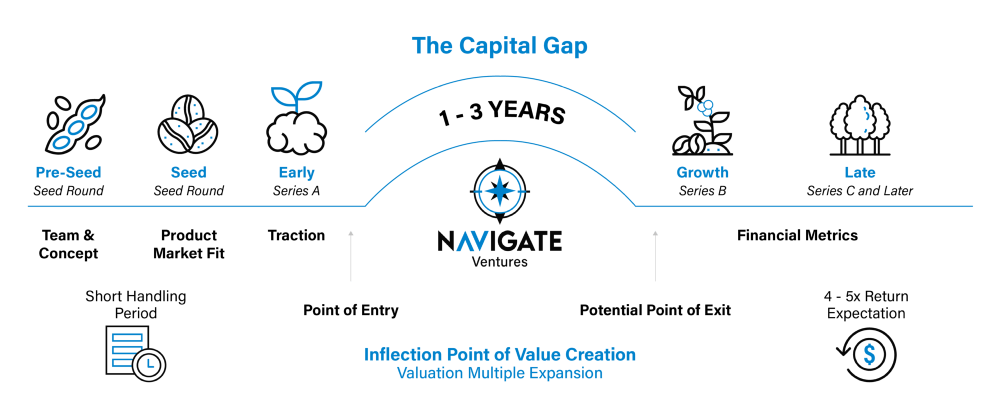

Most Startups Never Make It Past Series A

Each Year, Hundreds of New, Promising Startups Look for Growth Capital

Less than 25% Make it to the Growth Round

Lack of Product Market Fit and Team Issues are Common

Lack of Access to Growth Capital is the Most Common Issue

- Size and expectations for Growth Rounds have risen dramatically

- Growth Round is the hardest to raise as the goal post has moved

- It takes longer to achieve the required metrics to raise a Growth Round

- Many CEOs lack the experience, time, resources or relationships to successfully raise a Growth Round

The end result is many companies with Good Teams, Product Market Fit, and Strong Unit Economics find they need more Time & Capital to be able to raise a Growth Round.

TOP REASONS WHY STARTUPS FAIL

Ran Out of Cash/Failed to Raise New Capital

No Product Market Fit

Out Competed

Flawed Business Model

Typical Investment

-

Early Venture Risks Have Been Mitigated

-

Stage

-

Sector

-

Required Size of the Round

-

Quality Existing Investors

-

Appropriate Pre-Money Valuation

-

Proven Product Market Fit

-

Deal Terms

-

Strong Unit Economics

-

Potential Size of the Next Round

-

Poised for High Growth over the Next 24 Months

-

Visible Path to the Next Round