Link to the original article: https://pitchbook.com/

A week of mega-IPOs capped off a year that has refashioned the traditional bridge between public and private markets.

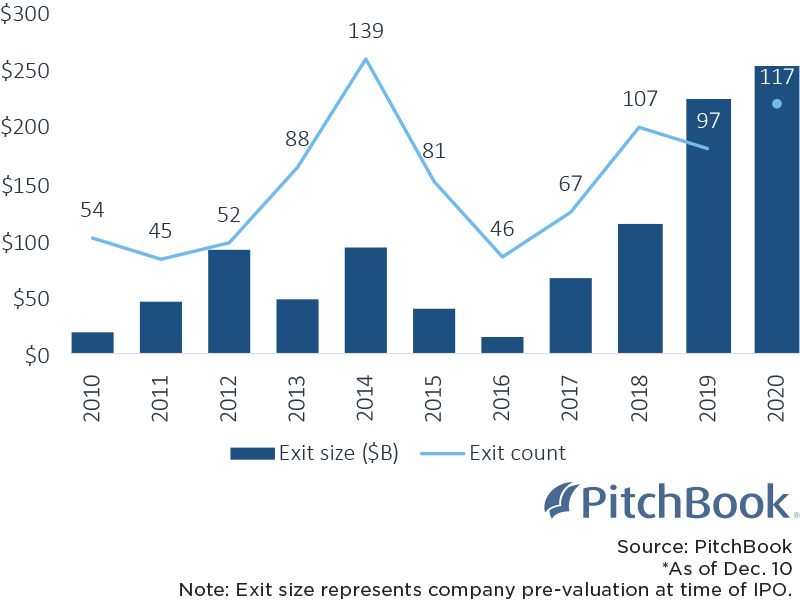

Richly valued tech offerings this week from Airbnb, DoorDash and C3.ai pushed the value of all VC-backed IPOs in 2020 to a decade high. The flurry of deals brought total exit value—or pre-valuation at time of IPO—to more than $253 billion this year, blowing away the high-water mark of $224 billion that was set last year, according to PitchBook data.

Beyond the blockbuster listings, 2020 will be remembered for a series of experiments in the way private companies tap into public markets, from new IPO pricing mechanisms to blank-check mergers and direct listings. This year’s crop of deals also broadened the pool of public stocks, serving up fast-growing companies to ravenous investors despite a recession that hurt many companies’ bottom lines.

“2020 has bucked all your expectations of the year,” said Cameron Stanfill, a venture capital analyst at PitchBook.

With 117 VC-backed IPOs through Thursday, 2020 was one of the busiest for Wall Street deal makers for the past 10 years, second only to the 139 deals done in 2014.

Exit value of VC-backed IPOs on US exchanges

This year’s IPO parade reflected a combination of tech exuberance and a resilient stock market underpinned by government aid and aggressive support by Federal Reserve policymakers.

But the rush by venture-backed companies to take advantage of public-market interest carries risks, and some of them may find it difficult to defend those post-IPO valuation multiples.

“The higher the valuations are, the lower the upside potential,” said Jay Ritter, a University of Florida professor of finance known for his IPO research.

Valuation multiples have risen across the board, with growth-stage technology companies leading the charge.

Investors’ growing appetite for new stocks follows a decades-long decrease in the number of US-listed public companies may also be contributing to an increased appetite among investors for IPOs. This year’s crop of stock offerings got a major boost from the launch of more than 200 special-purpose acquisition companies that seek to merge with private companies.

While tech stocks drove most of the headlines in 2020, healthcare and biotech offerings continued, as in past years, to lead US IPO activity.

Healthcare dominated the IPO tally with 82 deals to date, compared with just 16 for companies in the IT industry and 11 consumer companies. But debuts by tech and consumer names accounted for nearly three-quarters of the exit value.

Biotech and healthcare stocks, traditionally viewed as defensive plays, can be attractive even in times of economic weakness. Investor interest in those companies only intensified as the pandemic set off a worldwide race for vaccines and drug treatments.

The IPO parade of 2020 also featured several new developments on how companies go about the business of going public.

Some of the year’s largest deals—including Airbnb, DoorDash and Unity Software—used an auction process to settle on IPO share prices, a thorny subject that has led to intense debate among investors.

Each of the companies using the new auction approach eventually priced their IPOs well above their initial targets, which according to Ritter indicates the auction was useful in gauging demand.

On the other hand, those auctions didn’t help the companies avoid a first-day stock “pop” that is sometimes viewed as evidence that a company’s shares were underpriced. Airbnb’s stock closed its first day of trading up 135%, DoorDash 86% and Unity 32%.

Palantir and Asana revived the direct listing, an IPO alternative in which no new shares are sold and the stock price is set by public demand. Both companies saw their shares rise in recent months, with Palantir’s up nearly 200% since its Sept. 30 debut.

“Everyone’s trying to figure out what are the adaptations that improve outcomes,” said Jeff Housenbold, managing partner at SoftBank and DoorDash board member. “I think you will see more and more improvement in how companies go public.”

The rapid rise of special-purpose acquisition companies has also given tech startups a third path to go public. Among those taking the SPAC route were home-buying startup Opendoor and electric vehicle startups like Nikola and Fisker.

Looking ahead, some investors voiced optimism about the legacy of this year’s IPO bounty.

Nihal Mehta, founding general partner at Eniac Ventures, likened the current market conditions to “a coiled spring” that’s releasing pent up energy. He said the post-vaccine world could resemble the Roaring Twenties, a time of headlong economic growth that followed World War I and the last major global pandemic.

Only a select few IPOs in the future are likely to pull off the kinds of big valuation jumps seen in 2020. A rotation out of growth stocks is already underway and may continue as investors contemplate what a rollout of vaccines means for businesses, said David Sekera, chief US market strategist at Morningstar.

For the IPO market to keep up its recent momentum, it may have to attract more of the super-sized tech offerings that powered recent highs.

Investment platform Robinhood and grocery delivery company Instacart are said to be pursuing listings for early 2021, and both have been privately valued at more than $10 billion.

But as Airbnb’s long and circuitous path to public markets shows, planning for the unexpected is all part of the process.

“I wish I could forecast the future,” Ritter said. “One thing I’m certain about is the stock market will not go up smoothly forever.”