Link to original article: Sam Altman’s Investment Web: Where the OpenAI CEO is investing in AI, biotech, energy, and more

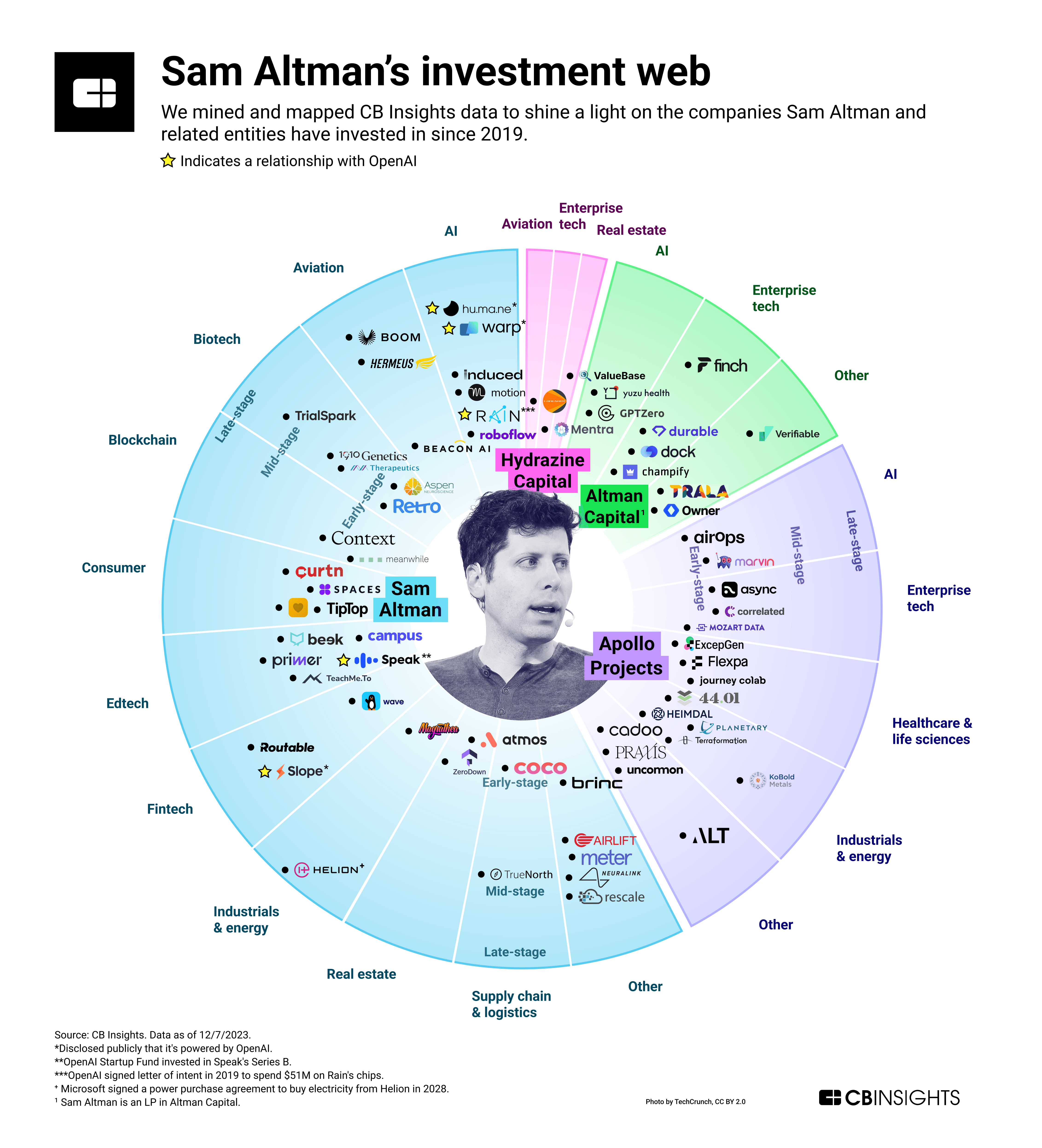

We mined CB Insights data to uncover the companies Sam Altman and related entities have taken stakes in since 2019.

As the CEO of OpenAI, Sam Altman has become the face of the generative AI movement.

Prior to heading up OpenAI, he was president of Y Combinator, one of the most successful startup accelerators in the world, from 2014 to 2019.

Behind the scenes, Altman is a remarkably active angel investor — with over 100 investments since 2010, including rounds to Stripe, Reddit, and Instacart.

In addition to his individual investments, he is the founder of VC firm Hydrazine Capital and investment fund Apollo Projects, launched with his brothers Max and Jack Altman. Altman Capital, which is managed by Jack, also counts Sam as a limited partner.

His investments highlight wide-ranging interests, including lab-grown meat, longevity, energy, education — and, of course, artificial intelligence.

We mapped out Sam Altman’s universe of portfolio companies by category since 2019. We also note where companies have publicly disclosed a relationship with OpenAI.

Below the graphic, we break down the most notable areas of activity.

SAM ALTMAN’S INVESTMENTS OVERLAP WITH OPENAI’S STRATEGY

Several of the companies Altman has backed also have relationships with OpenAI. For instance, Altman has backed 3 rounds to Humane, which recently released its “Ai Pin” — a wearable device whose core feature is a personal assistant powered by ChatGPT.

Two of Altman’s other investments — B2B payments automation platform Slope (Series B) and coding assistant Warp (Series B) — have both disclosed that OpenAI’s models are in part powering their products.

Meanwhile, OpenAI signed a letter of intent to spend $51M on AI chips from Rain in 2019. Altman had previously invested in the company’s seed round.

AI-powered language learning app Speak, whose Series A Altman backed in 2022, has since raised successive rounds from OpenAI’s Startup Fund and other investors.

While OpenAI is not an investor in the OpenAI Startup Fund (the fund’s backers include Microsoft and other OpenAI partners), Speak said its Series B raise “unlocks a deeper relationship where OpenAI’s systems will power more of Speak’s user experience, and Speak will gain advanced access to new systems in development.”

TWO BIGGEST BETS ARE IN ENERGY & LONGEVITY

In November 2021, Sam Altman contributed $375M to nuclear fusion startup Helion’s $500M Series E raise — his largest personal investment to date.

Altman wrote on his blog at the time of the investment: “Helion is by far the most promising approach to fusion I’ve seen.” In May 2023, OpenAI-backer Microsoft signed an agreement to buy electricity from Helion later this decade.

Altman’s other major bet is anti-aging startup Retro Biosciences. He’s invested a total of $180M in the company, which aims to extend life spans via cellular reprogramming.

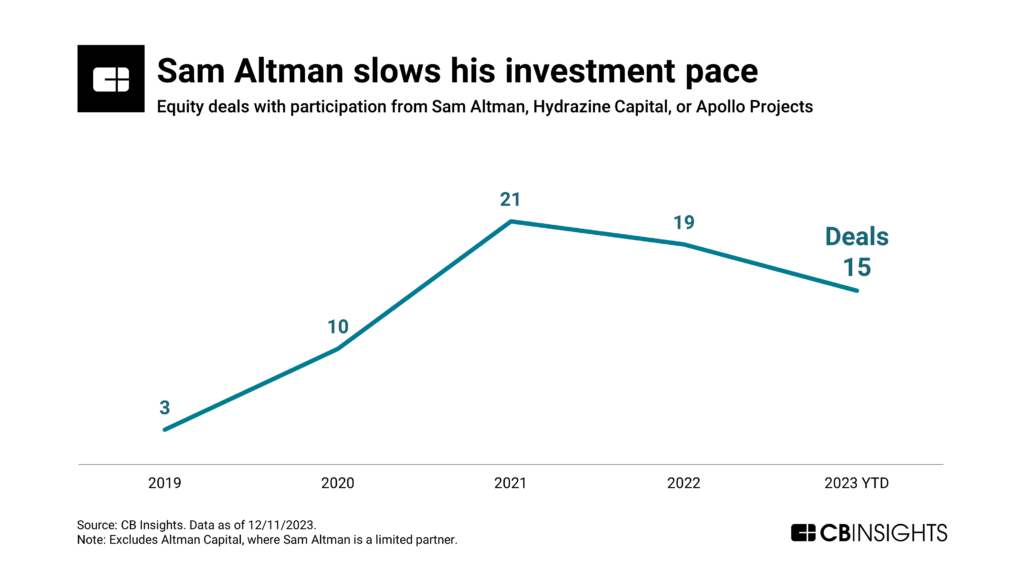

DEALMAKING SLOWS DOWN IN 2023 BUT REMAINS HIGH

Sam Altman and related entities have invested in 15 deals this year — down from a high of 21 in 2021, though still elevated compared to years prior.

Altman’s dealmaking is concentrated at the early stages (seed/Series A), which represent more than two-thirds of his deal activity since 2010.

Altman has also backed multiple deals to select startups as they’ve scaled, including 3 each to Humane, lab-grown meat company Uncommon (via Apollo Projects), and computing startup Rescale.

NOTABLE EXITS

Altman has invested in numerous edtech startups of their years. One of them — Codecademy, which he backed in 2011 — was acquired for $525M by SkillSoft in December 2021.

Other early investments that went on to exit include Instacart (the company IPO’d in September 2023) and Cruise (acquired by General Motors in 2016).

In addition, Altman is behind 3 SPACs:

- AltC Acquisition Corp., where he is executive officer, is planning a merger with nuclear fission startup Oklo (where he is chairman of the board).

- He is on the board of directors for Bridgetown Holdings, which merged with fintech MoneyHero in October 2023, and Bridgetown 2 Holdings, which merged with proptech company PropertyGuru in 2022.