Link to original article: Which VCs invest the most often after top accelerators?

We break down who invests in the most startups coming out of Y Combinator, Plug and Play, Techstars, and other accelerator programs.

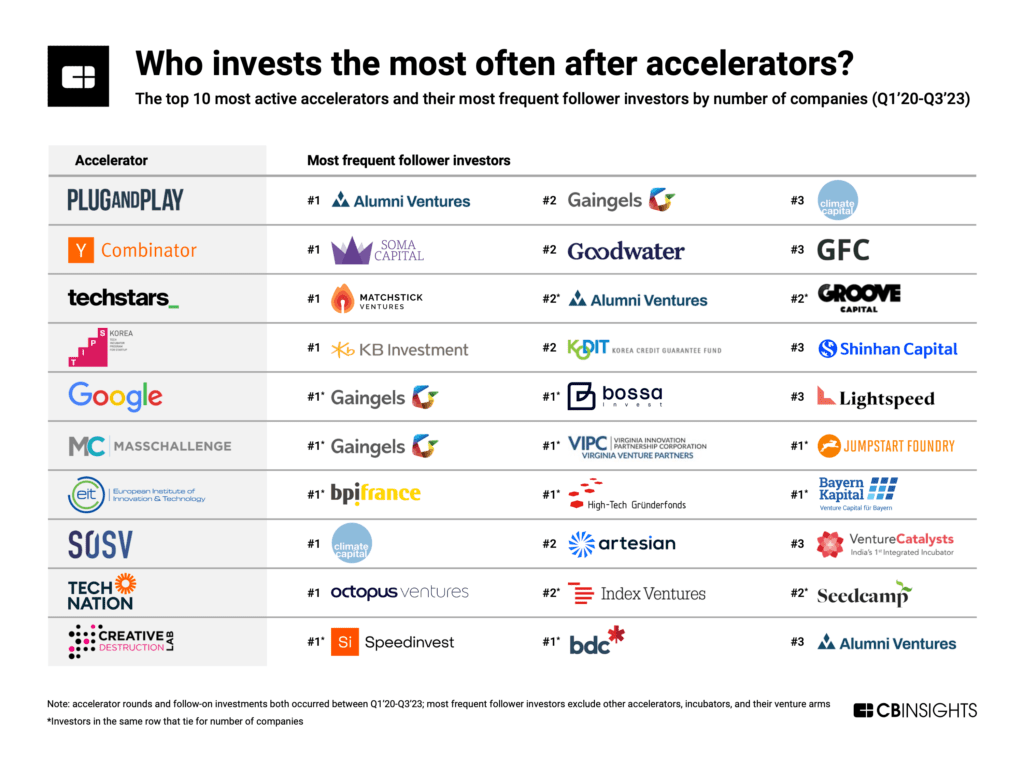

As accelerators become a stronger force in the venture ecosystem, other investors are relying on accelerators’ graduating classes to find their next deal. But which investors back the most startups coming out of Y Combinator (YC), Plug and Play, and other top accelerators?

For VCs and other early-stage investors, the answer to that question helps demonstrate what accelerator relationship networks look like. For startups, the answer signals who they should look to impress next.

Below, we break down the most frequent follower investors of the world’s top 10 most active accelerators.

KEY TAKEAWAYS

1) YC follower investors are in a league of their own

When comparing the top 3 follower investors for each accelerator here, Y Combinator’s followers invested far more often than others.

Soma Capital is YC’s most frequent follower investor, having backed over 130 companies after they graduated from YC between Q1’20 and Q3’23. Following Soma are Goodwater Capital (backing nearly 90 YC companies during that time) and Global Founders Capital (over 60 YC companies).

In comparison, the top 3 follower investors of the other accelerators backed anywhere between 4 and 46 batch companies during the same period.

So why do VCs come to YC grads at such a high rate? The track record.

YC has over 80 unicorns (private companies valued at $1B+) in its portfolio — the 8th-most of any investment firm in the world. Among Soma Capital’s 18 portfolio companies that are unicorns, more than half were once YC-batch startups.

2) Investor networks are accelerators’ best friends

Two investor networks — Alumni Ventures and Gaingels — appear as top 3 follower investors for multiple accelerators.

Alumni Ventures is an investor network of over 9,000 individual accredited investors and has raised over $1B in capital to deploy in companies. It’s the #1 follower investor for Plug and Play and #2 for Techstars, having invested in 15 and 9 batch companies, respectively, between Q1’20 and Q3’23.

Gaingels, an investor network supporting LGBTQIA+ representation in VC with over 2,000 accredited investors, is tied as the top follower investor for Google accelerators and MassChallenge, as well as #2 for Plug and Play. The number of investments in each of these accelerators’ portfolios ranges from 4 to 14 in the analyzed period.

3) Geography matters for follower investors

Many of the most frequent follower investors are located in the same areas as the accelerators, especially outside of the US.

For example, all 3 of TIPS’ top followers (KB Investment, Korea Credit Guarantee Fund, and Shinhan Capital) are located in the same country, South Korea, with 2 of the 3 in the same city of Seoul.

Tech Nation is headquartered in London, England, and all 3 of its top followers — Octopus Ventures, Index Ventures, and Seedcamp — are also located there.

Meanwhile, the top 3 follower investors for the European Union’s EIT, which focuses on backing European startups, are all European: Bpifrance (France), High-Tech Grunderfonds (Germany), and Bayern Kapital (Germany).

4) Follower investors tend to be vertical-agnostic

Twenty-one of the 25 most frequent follower investors listed on the map invest across verticals, with most focusing on seed investments (hence investing in accelerator batches).

The four exceptions are:

- Climate Capital focuses specifically on climate tech to reduce emissions, decarbonize industries, and more. It’s the most frequent follower investor for SOSV and third-most frequent for Plug and Play.

- Goodwater Capital only invests in B2C verticals. It’s the second-most frequent follower for Y Combinator.

- High-Tech Grunderfonds is tied as EIT’s #1 follower investor and focuses on high-tech verticals like industrials and life sciences.

- Jumpstart Foundry is a healthcare pre-seed fund and is tied as MassChallenge’s top follower investor.