Link to original article: The future of big tech in 10 charts

Big tech has grown revenue at a breakneck pace for years. But their size — plus intensifying competition and the generative AI boom — is pressuring tech giants to find new growth avenues.

Big tech companies — Alphabet (Google), Amazon, Apple, Meta, Microsoft, and Nvidia — are on track to earn more than $1.65T in aggregate revenue this year. The group has already notched over $200B in profits in 2023.

Nvidia’s entrance into the “big tech” ranks comes on the back of the AI revolution: the AI chipmaker saw its revenue soar 206% year-over-year (YoY) in its fiscal quarter ended October 29.

However, for big tech companies to continue their frenetic pace of growth, they must add billions to their balance sheets each quarter.

Heightened competition across these companies’ core business lines (cloud computing, advertising, etc.), plus the generative AI shift, is putting pressure on big tech to cut costs and tap into new markets.

We dive in below across 10 charts.

BIG TECH’S DOMINANCE

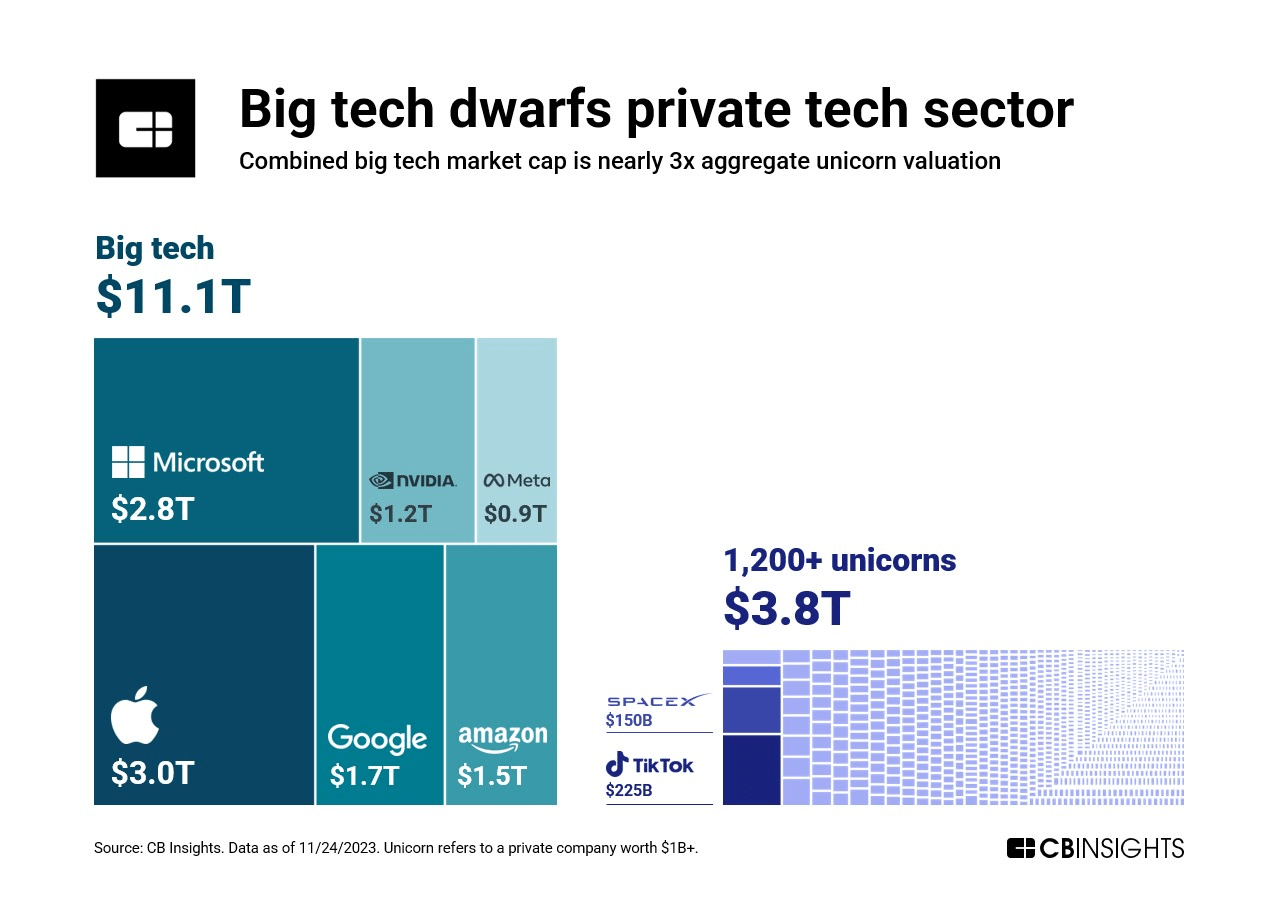

Big tech’s prominence in the tech sector is evident in its sheer size compared to the most valuable tech startups.

The 6 tech giants hold an aggregate valuation of over $11T — nearly 3 times that of the entire billion-dollar unicorn club.

Even the largest unicorns are unlikely to be big tech contenders any time soon.

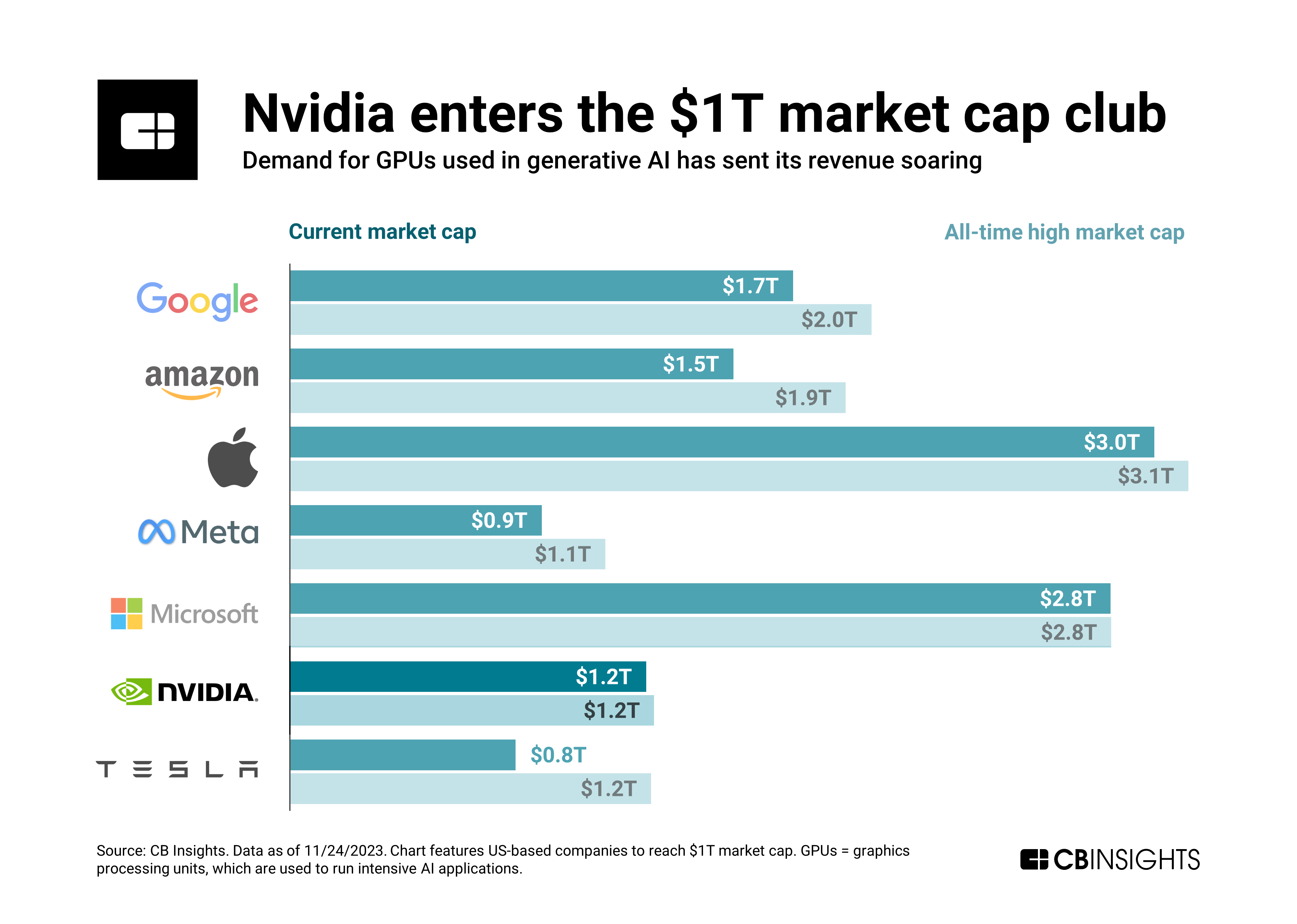

THE CLUB GAINS A NEW MEMBER

Nvidia’s dominance as an AI chipmaker has lifted it into the big tech ranks. The company hit a $1T market cap in Q2’23.

Its rise signals the next platform shift as companies rush to harness AI’s potential.

REVENUE GROWTH SLOWS

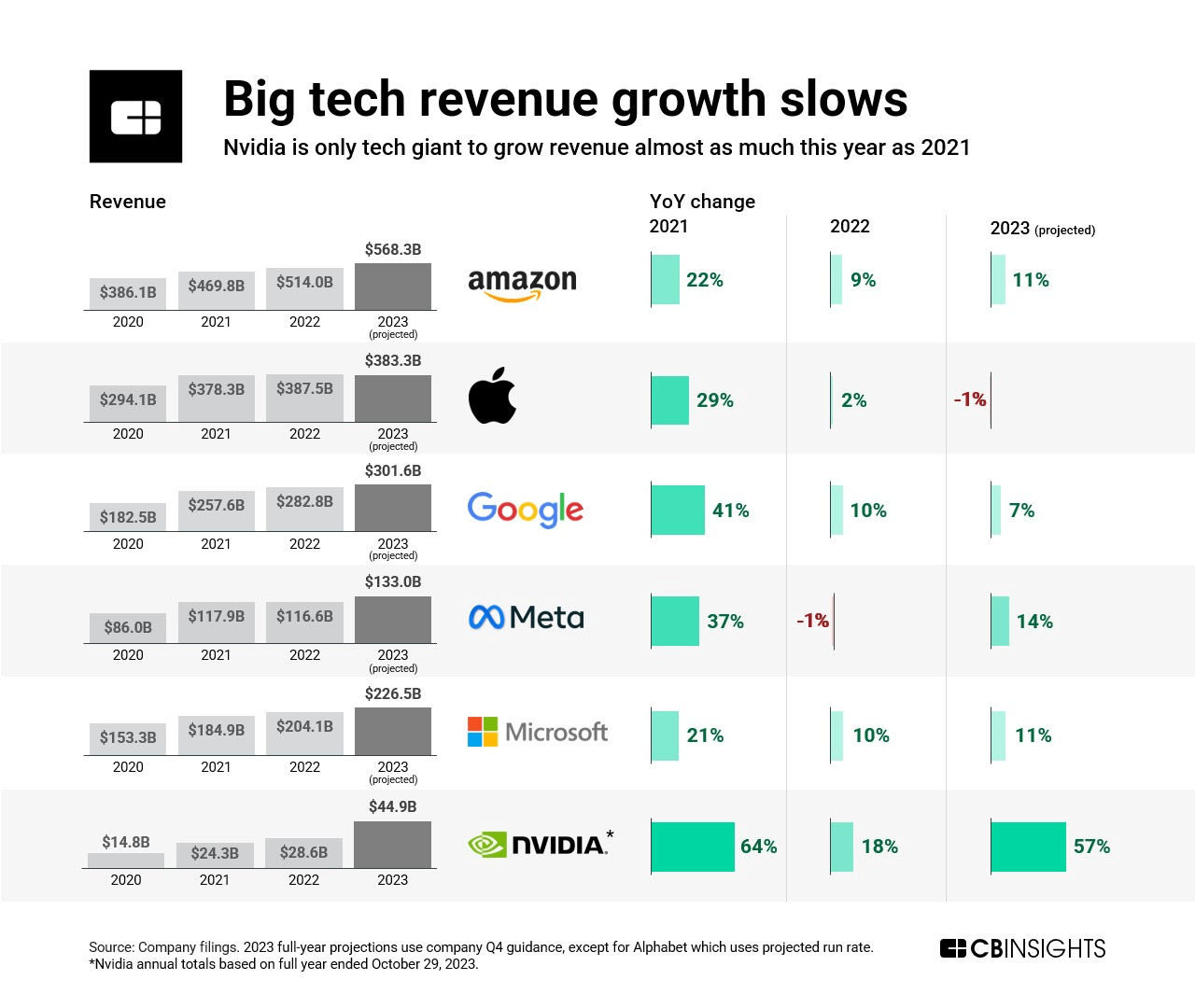

Over the years, big tech has grown revenue at an astounding rate.

But broadly, these companies’ growth is slowing as they get bigger.

To fuel growth moving forward, they’ll be looking to reach into new markets, while staying at the cutting edge of emerging technologies like generative AI, quantum, and AR/VR.

A RETURN TO EFFICIENCY

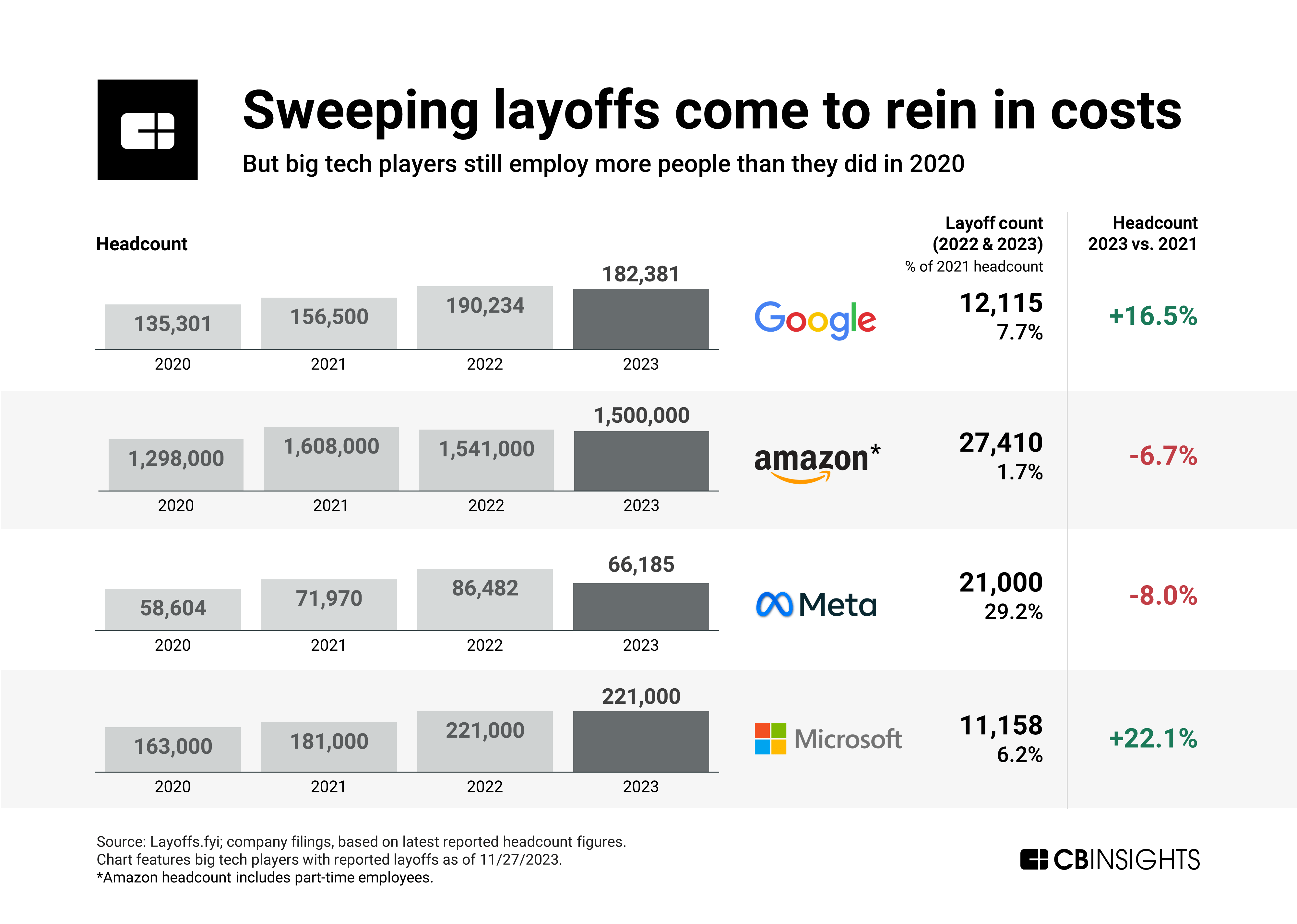

Even big tech players over-expanded in 2021 and have subsequently moved to cut costs.

Though they still employ far more people now than they did in 2020, the pace of hiring will likely remain slower, with a focus on keeping expenses in check.

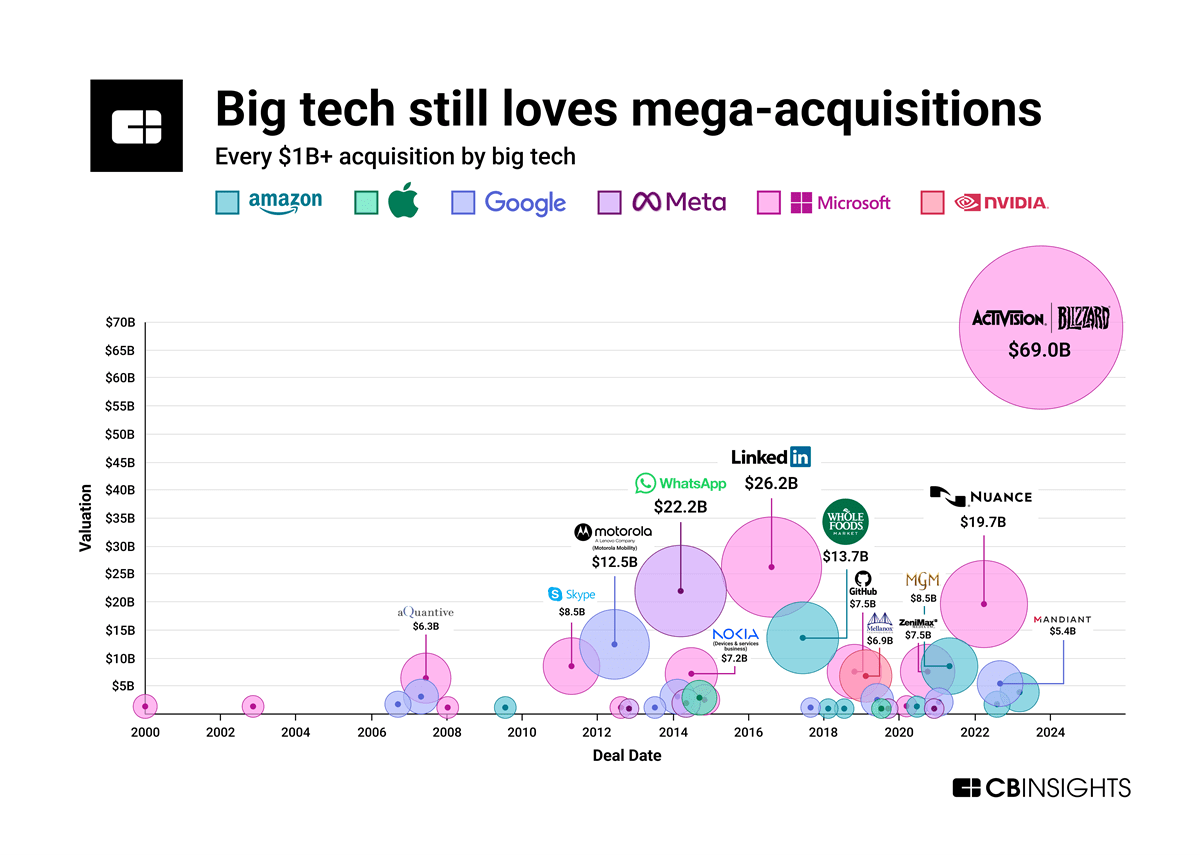

BLOCKBUSTER ACQUISITIONS

Large acquisitions have historically been key for big tech to bring in new revenue sources as well as launch new product lines.

WhatsApp, acquired by Facebook in 2014, now has more than 2B users globally and is among Meta’s fastest-growing services in the US.

But regulatory pressure has put a damper on this activity, as we highlight below.

Microsoft’s $69B acquisition of Activision, which finalized in October 2023, is a recent notable exception. It will bring $7.5B of revenue to Microsoft’s top line.

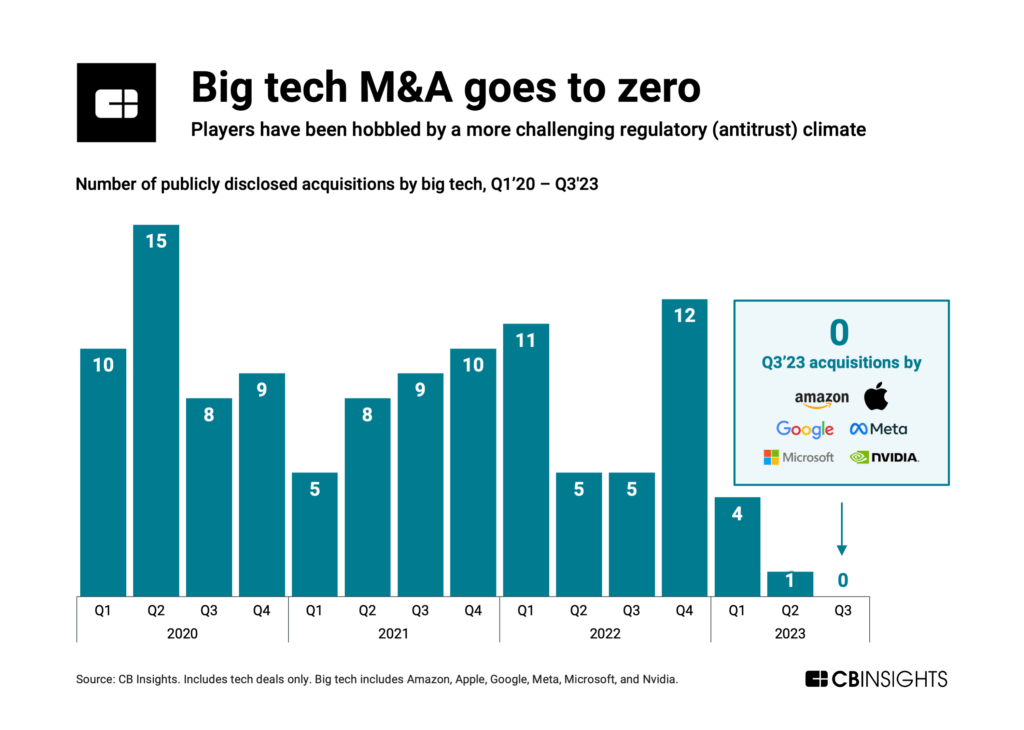

REGULATORY PRESSURE PUTS DAMPER ON M&A

Big tech M&A volume flatlined in Q3’23.

Though tech giants haven’t gone completely quiet — Microsoft’s Activision deal closed in Q4 after a nearly 2-year fight with regulators — a healthy tech ecosystem requires that they get back in the game. This is likely challenging with the FTC’s current posture.

In the meantime, expect smaller deals from these players going after key tech capabilities or talent.

For example, in Q4’22, Apple CEO Tim Cook said, “We’re constantly looking in the market and…[at] which things would provide either intellectual property or talent or preferably both that we would need. And so we’re constantly looking at acquisitions of all sizes.”

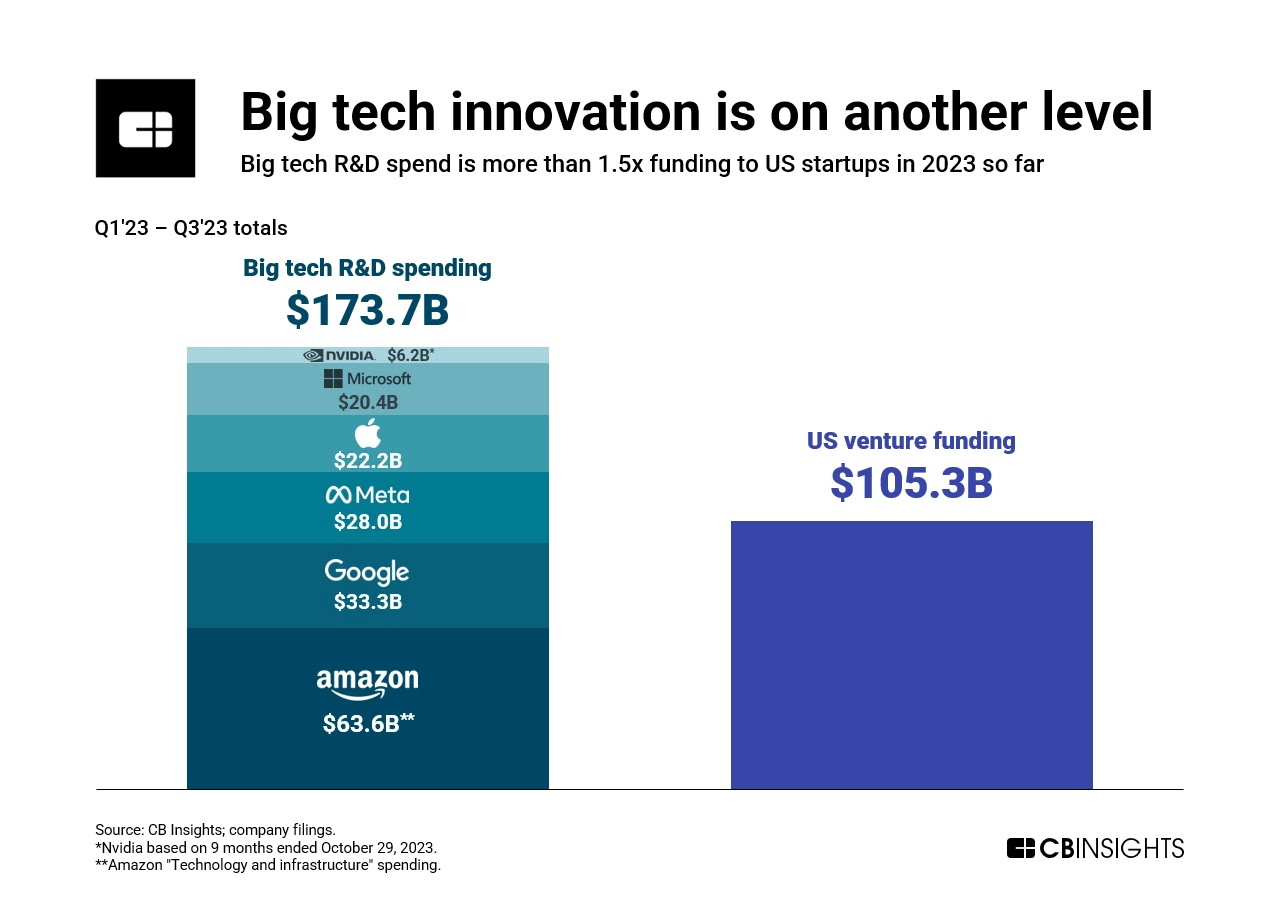

BIG TECH R&D SPENDING FAR EXCEEDS US VC

In the US, big tech companies’ R&D investment outpaces that of overall US venture funding by a wide margin. This underscores the scale these companies play in driving tech innovation.

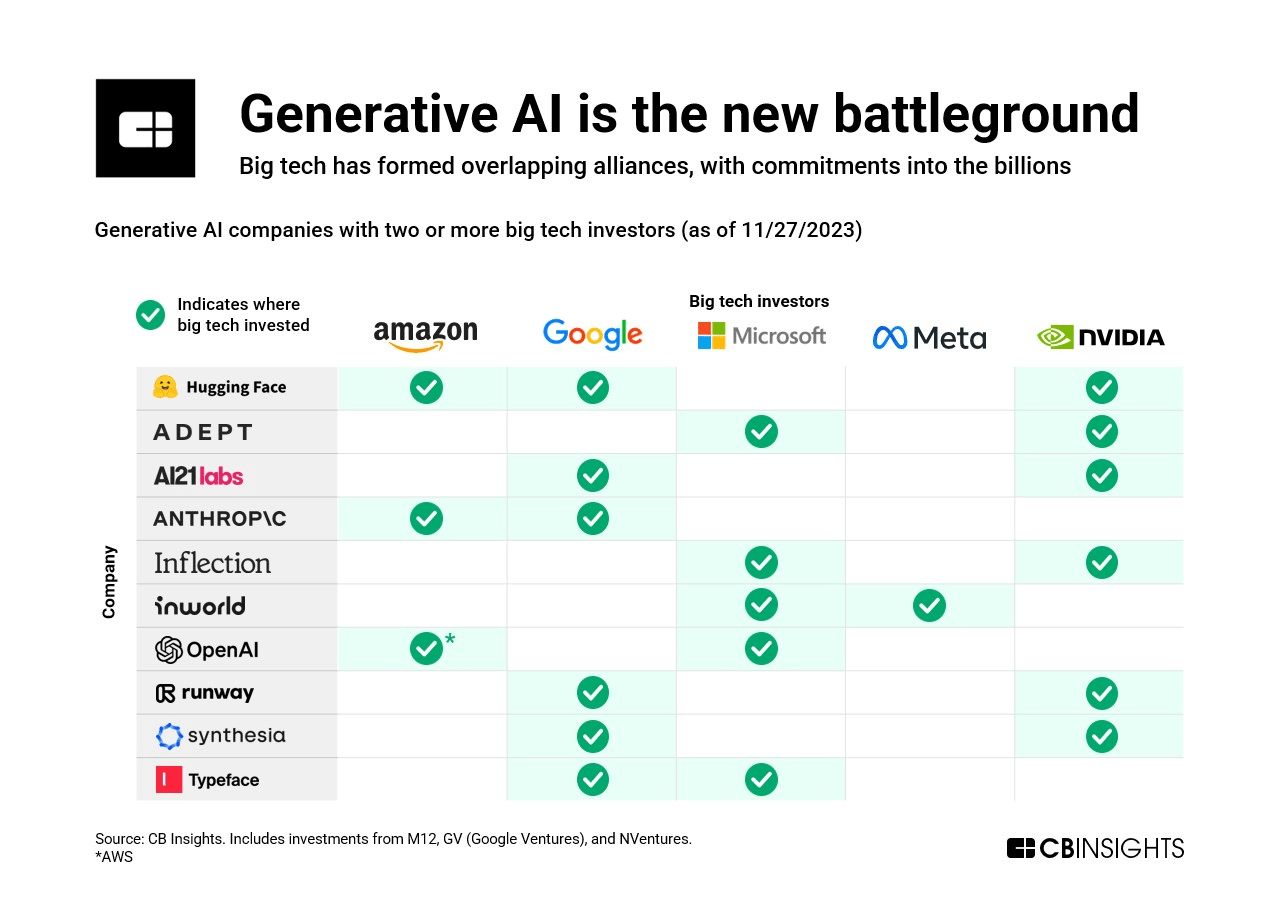

ALL IN ON AI

Tech giants are throwing their weight behind promising AI startups, offering computing power and funds for development, especially in the realm of generative AI.

These investments in turn could feed into their core business focuses, such as cloud computing (Google, Amazon, Microsoft) and AI chips (Nvidia).

CONVERGING ON EACH OTHER’S TERRITORY

Big tech’s revenue sources are increasingly overlapping.

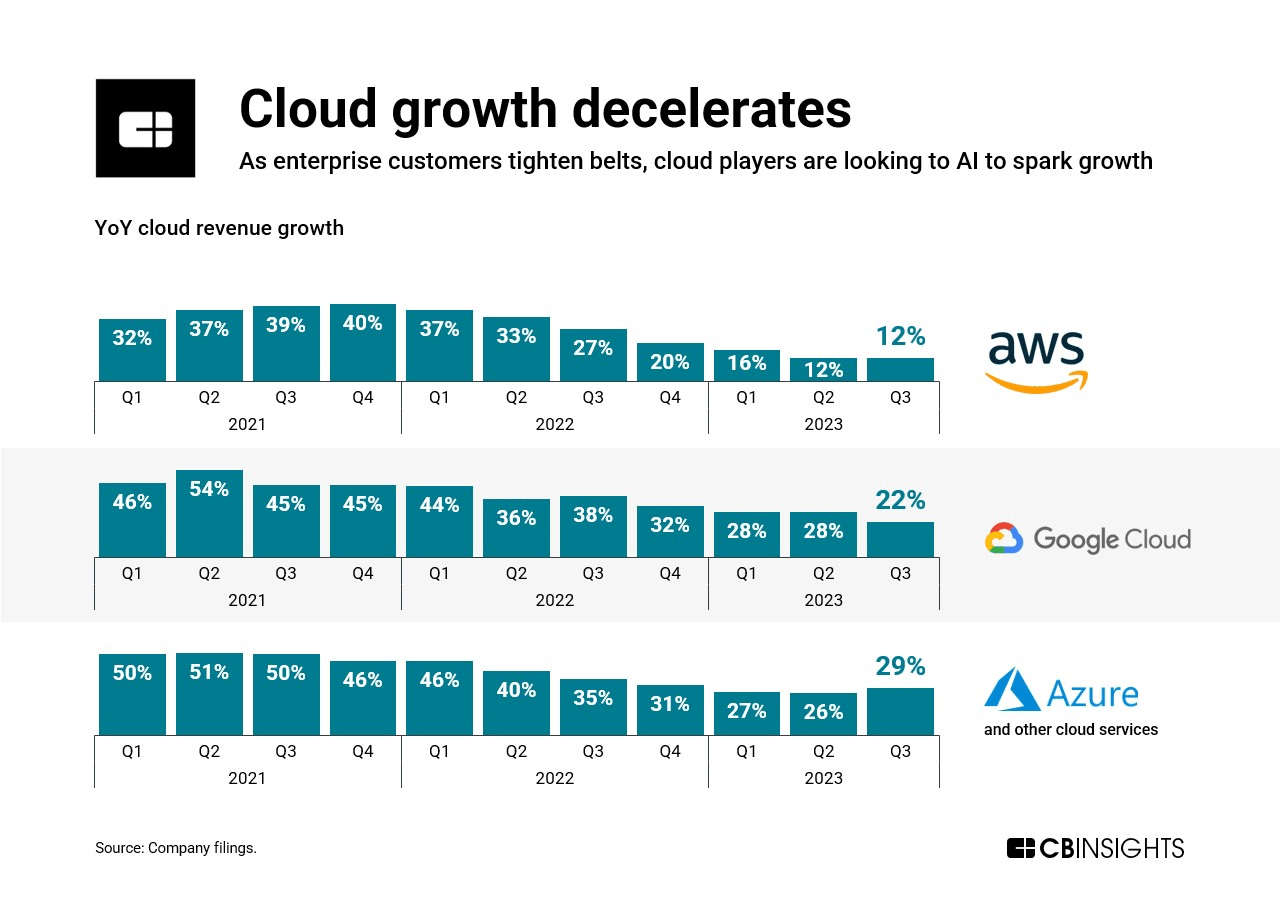

Cloud computing revenue growth, for example, has slowed amid heightened competition and as enterprise customers optimize their workloads.

Instead, Amazon, Microsoft, and Google are looking to compute-hungry AI to fuel their cloud computing businesses. Microsoft attributed 3 percentage points of Azure’s growth in the most recent quarter to AI.

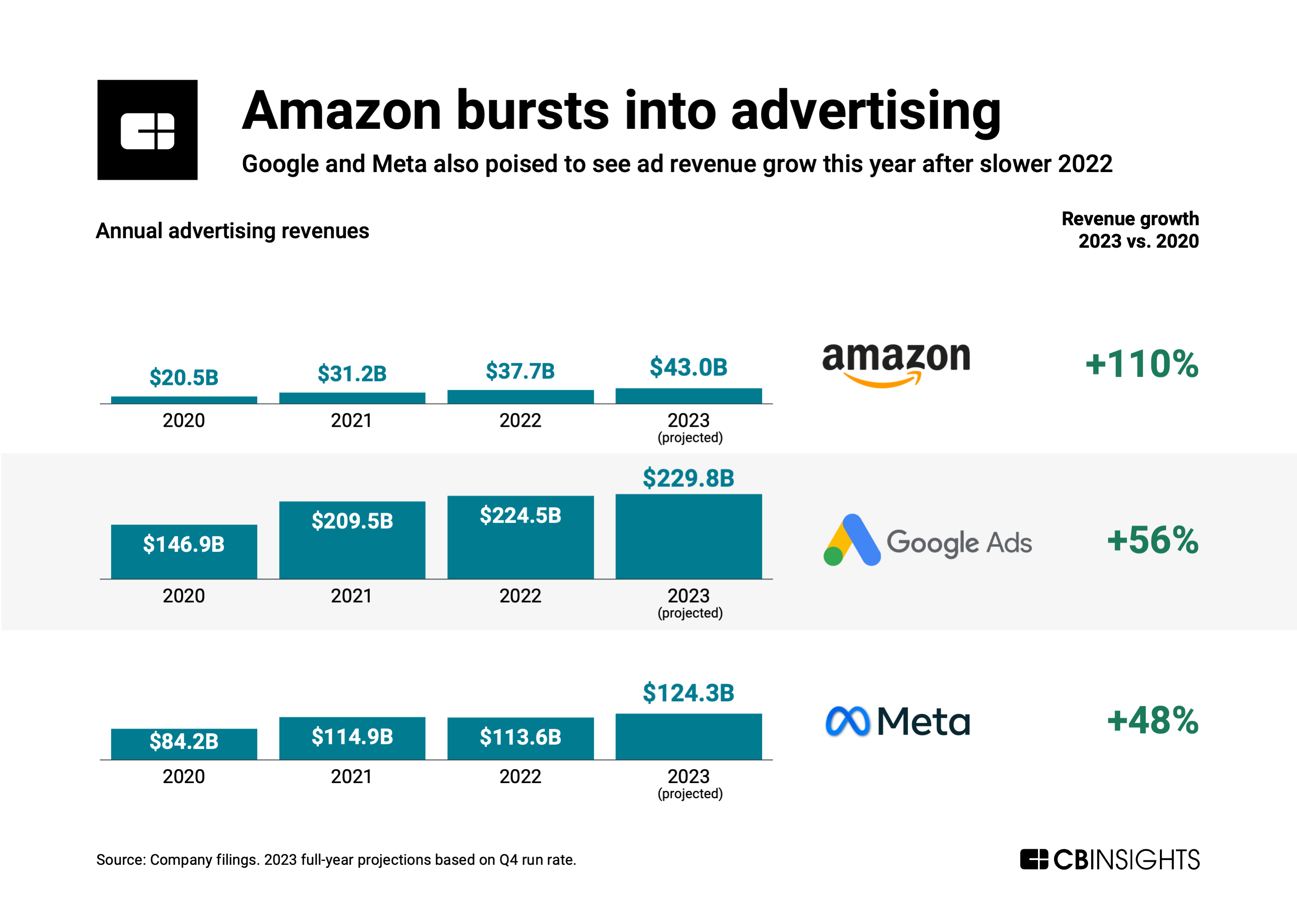

Meanwhile, Amazon is continuing to gain share from leaders Google and Meta in the digital advertising realm.

As big tech advances on each other’s core businesses, players are also looking for growth in new markets.

Tech giants are bringing disruption to healthcare, fintech, telecom, and other verticals — but not without hiccups.