Link to the original article: US venture capital valuation trends in four charts

After a frenzied 2021, the venture industry is waking up to a sobering reality of economic and political volatility.

While the lag seen in private data will keep much of the immediate impact of falling asset prices out of this quarter’s figures, PitchBook analysts say that late-stage companies closest to the public markets already saw investor caution during the first quarter.

Here’s a closer look at four key trends from our Q1 US VC Valuations report that depict how deal sizes and valuations are reacting to market headwinds, rising interest rates, geopolitical tensions and more.

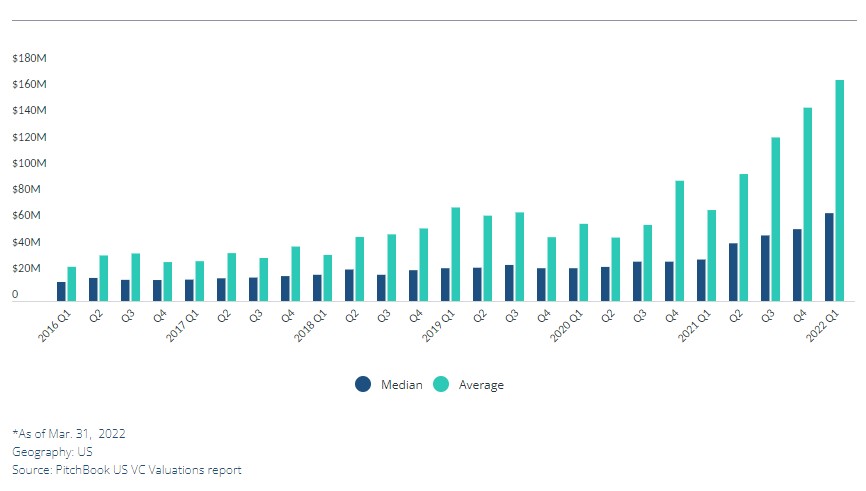

1. Early-stage valuations keep climbing

The early stage is a bit more insulated from volatility in the public markets than the late stage. The median valuation of early-stage deals reached a record $67 million in Q1—representing 112% year-over-year growth.

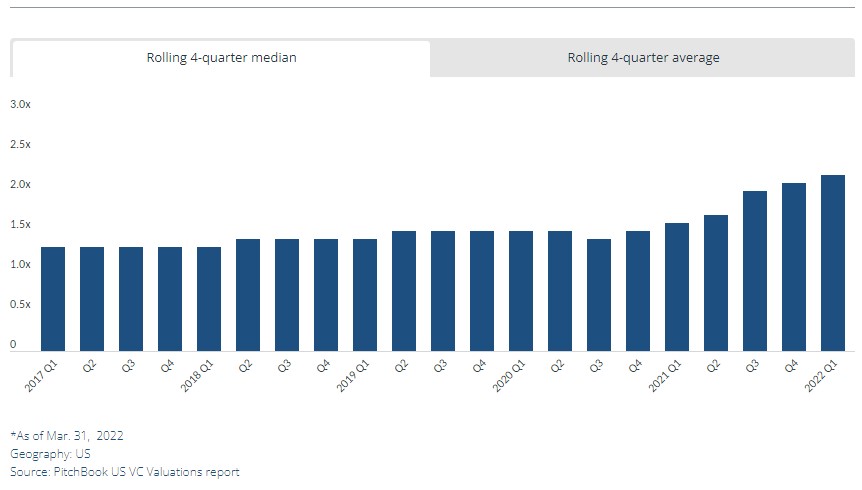

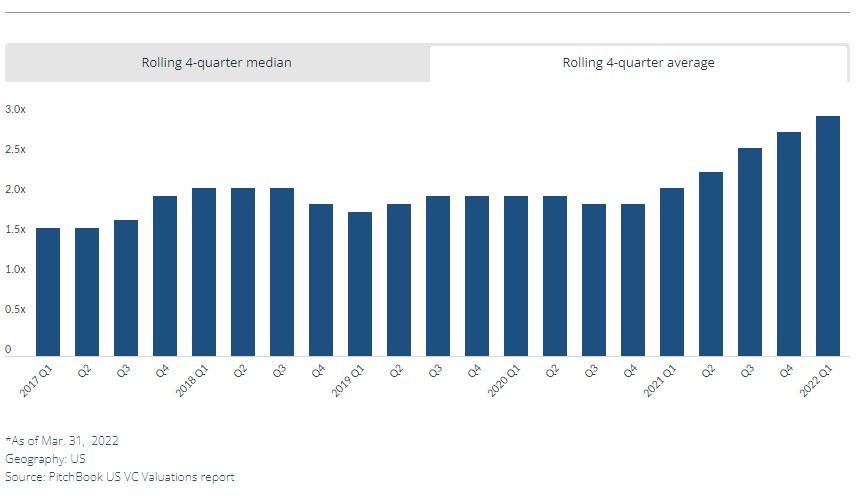

2. Late-stage step-ups maintain robust levels

Many late-stage companies raising capital in this slowing environment are still able to command high increases on their previous valuations, pushing median and average rolling valuation step-ups to record highs in Q1.

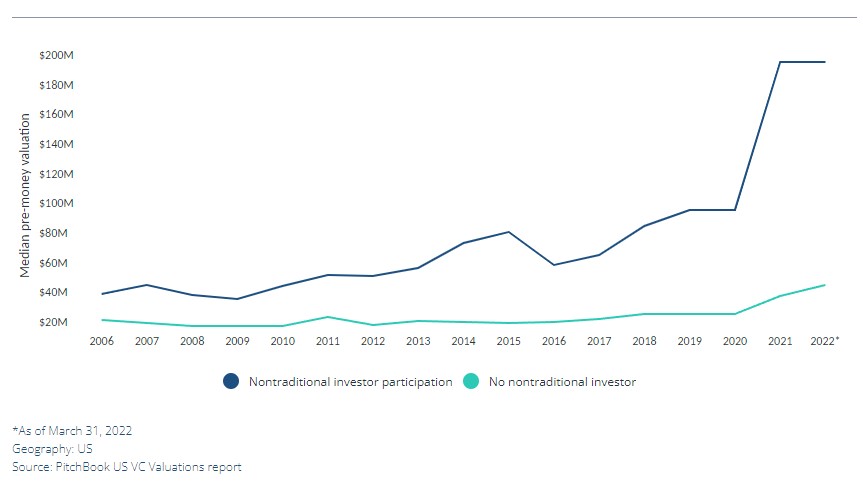

3. Late stage feeling pressure

Robust participation from nontraditional investors like corporate VCs, private equity firms and hedge funds added upward pressure on both deal sizes and valuations in recent years. But as the first three months of 2022 showed signs of a slowdown for US venture dealmaking, late-stage pre-money valuations in deals with nontraditional investor participation also plateaued from 2021’s median of $200 million.

On the deals front, nontraditional investors participated in $52.5 billion worth of deal value in Q1, less than in any quarter of last year, according to the latest PitchBook-NVCA Venture Monitor.

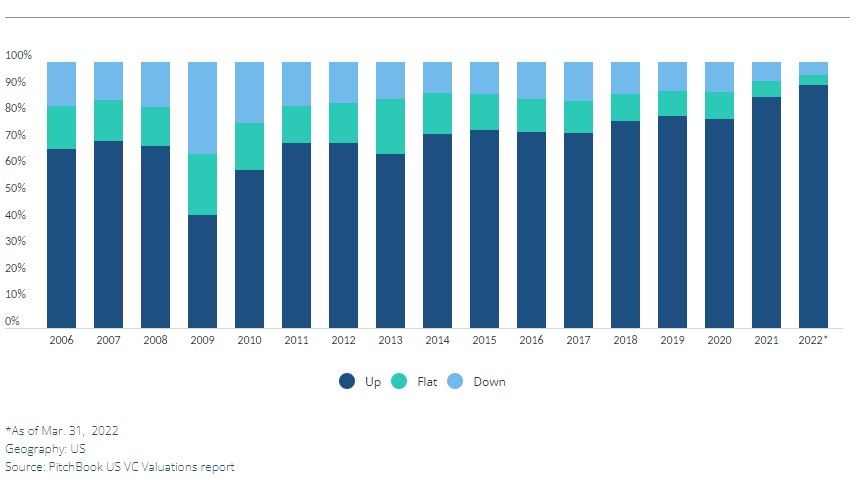

4. Down rounds yet to increase

Down rounds continue to make up a small portion of total deals, with just 5% of completed rounds in Q1.

The proportion of down rounds could increase in coming quarters if market headwinds persist. However, before there is a significant growth in down rounds, PitchBook analysts say the market will likely see a rebound of investor-friendly deal terms—a feature that has largely been absent from venture rounds in recent years.

Related read: US VC Valuations Report

Read valuations recaps from prior quarters: